The 2026 Enterprise CCaaS Strategic Evaluation

1. Executive Strategic Overview: The New Mandate for Experience Orchestration

The global enterprise landscape for Contact Center as a Service (CCaaS) has undergone a tectonic shift over the last thirty-six months, transitioning from a period defined by urgent cloud migration to an era of mature, AI-driven “Experience Orchestration.” For large multinational corporations—specifically those characterized by agent counts exceeding 1,000, multi-regional operational footprints, and intricate regulatory environments—the selection of a customer experience (CX) platform has elevated from a departmental IT procurement decision to a boardroom-level strategic imperative. The decision matrix in 2026 is no longer satisfied by the mere replication of on-premises telephony capabilities in the cloud; rather, the modern mandate requires the deployment of a platform that functions as the central nervous system for customer interaction data, intelligent automation, and workforce optimization.

Current market intelligence and analyst evaluations from late 2024 through the first quarter of 2025 indicate a distinct and accelerating consolidation of market leadership around a triad of primary vendors: Genesys, NICE, and Amazon Web Services (AWS). While formidable challengers such as Five9, Talkdesk, and Cisco continue to maintain significant footholds in specific market segments or geographic locales, these “Big Three” increasingly dominate the shortlist for Global 2000 decision-making. This dominance is predicated not merely on feature density, but on the pillars of massive scale, demonstrable financial stability, and a completeness of vision that aligns with the digital transformation trajectories of the world’s largest organizations.

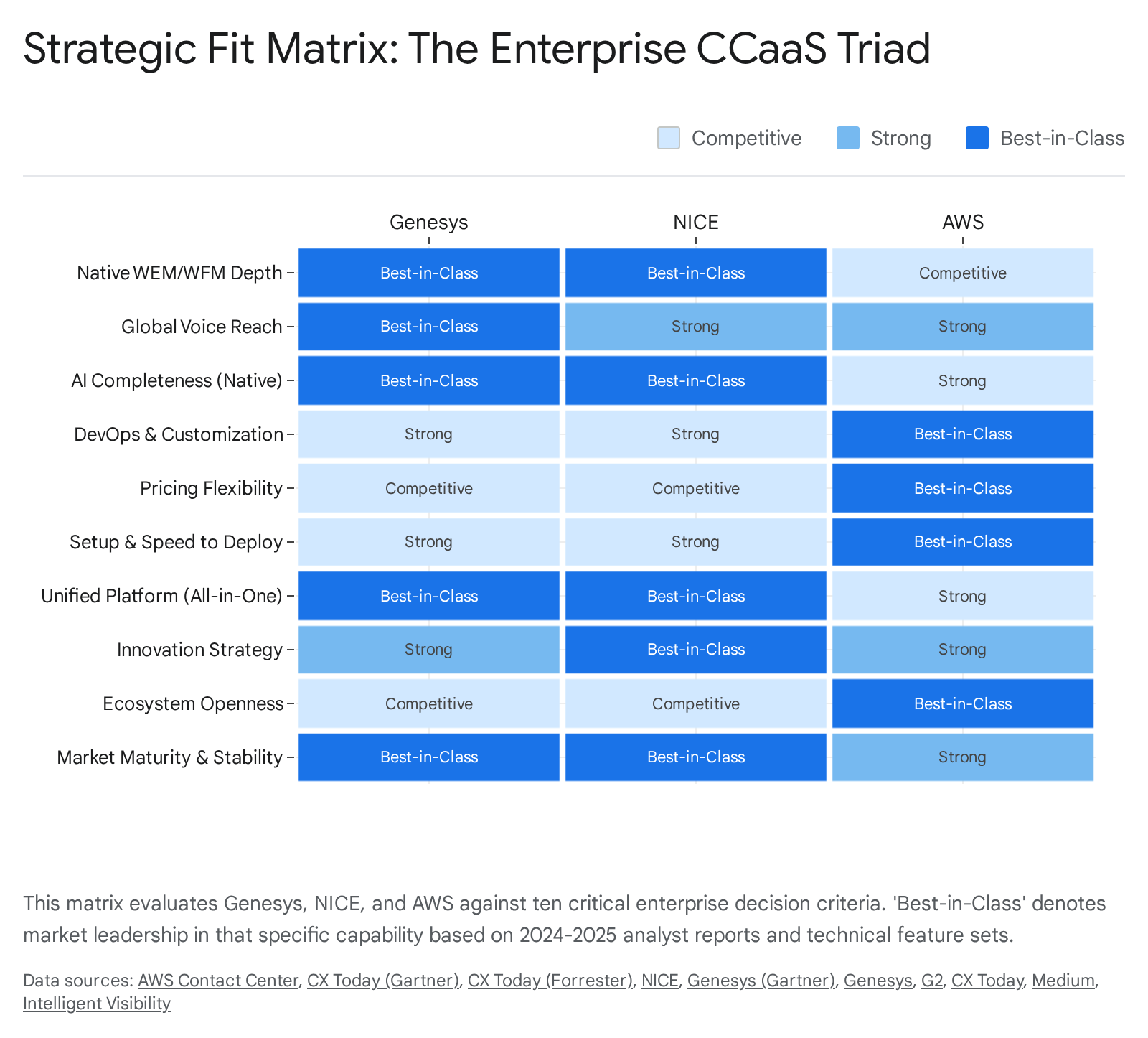

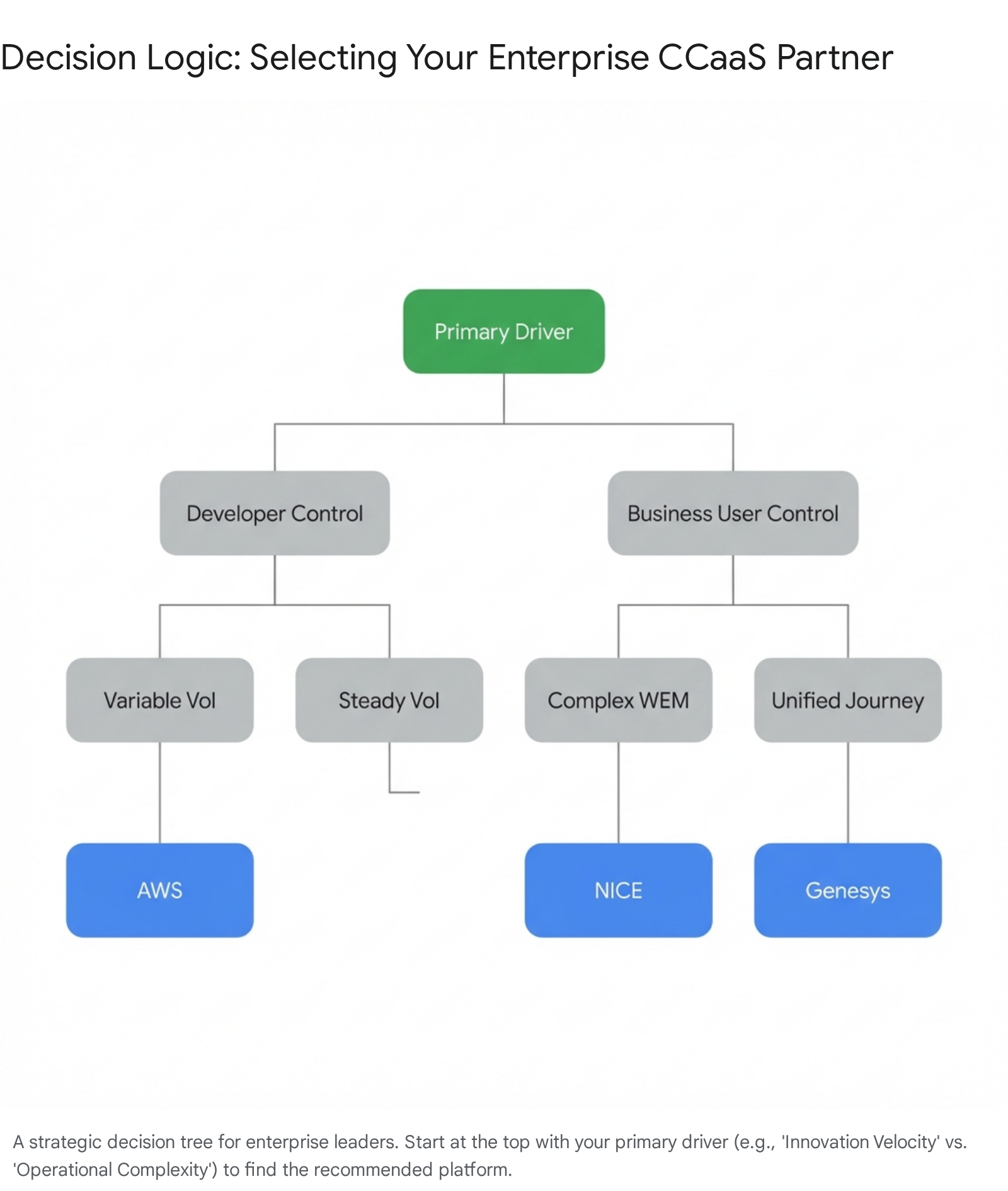

The concept of the “best” solution in this rarefied tier of the market is not binary. It is deeply contingent upon the specific organizational DNA of the enterprise in question. The analysis reveals three distinct “centers of gravity” in the market. Genesys Cloud CX has emerged as the premier choice for organizations prioritizing Experience Orchestration, effectively balancing deep functionality with a superior user experience (UX) and rapid innovation velocity. It currently ranks #1 in three out of five critical use cases in Gartner’s Critical Capabilities report, highlighting its versatility across high-volume and global operations. Conversely, NICE CXone holds the mantle for Operational Depth, particularly for enterprises where complex workforce management (WEM) and rigid compliance analytics are the primary drivers of value. Its position as the only “Customers’ Choice” in Gartner’s Peer Insights for 2024 underscores its stickiness in heavy-duty operational environments. Finally, Amazon Connect represents the Architectural Disruptor, appealing fundamentally to engineering-led organizations that view the contact center as a programmable capability rather than a packaged software application. Its consumption-based pricing model and deep integration with the broader AWS ecosystem offer a level of flexibility that is unmatched, albeit at the cost of requiring significant development resources.

This report provides an exhaustive, comparative analysis of these platforms, dissecting them against the critical criteria evaluated by large corporations: architectural resilience, AI maturity, global reach, Total Cost of Ownership (TCO), and regulatory compliance.

2. Market Dynamics: The Forces Shaping Decision Making

2.1 The Flight to Quality and Financial Stability

In an economic environment characterized by scrutiny on IT spend and a desire for vendor consolidation, large enterprises are gravitating toward providers with unassailable financial health. The risks associated with smaller, niche players—such as acquisition volatility or reduced R&D throughput—are driving a “flight to quality.” Genesys, for instance, has reported nearly $1.8 billion in Annual Recurring Revenue (ARR) as of late 2024, with its flagship cloud platform growing at an impressive 40% year-over-year. This growth trajectory suggests a massive, sustained investment in platform capability that smaller competitors struggle to match. Similarly, Five9 has surpassed the $1 billion annual revenue run rate, solidifying its position as a safe, viable enterprise alternative, particularly in North America and increasingly in European markets. NICE, leveraging its diversified portfolio of analytics and financial crime solutions alongside CCaaS, continues to demonstrate the scale required to support the largest global deployments, consistently appearing as a Leader in both Gartner and Forrester evaluations.

2.2 The Convergence of CCaaS and WEM

Historically, the Contact Center (ACD/IVR) and Workforce Engagement Management (WEM) were distinct markets served by different vendors. The modern enterprise requirement is for a unified suite. The friction of integrating a third-party WFM tool with a cloud routing engine is increasingly viewed as technical debt. NICE has long led this convergence with its “suite” approach, but Genesys has aggressively closed the gap, offering native WEM capabilities that are now considered sufficient for a vast majority of enterprise use cases. This convergence puts pressure on vendors like Amazon Connect, which, despite its routing prowess, often still necessitates the “bolting on” of partner solutions (like Calabrio or Verint) for complex scheduling needs, thereby reintroducing the integration complexity that CCaaS was theoretically designed to eliminate.

2.3 The AI Pivot: From Novelty to Utility

Artificial Intelligence has transitioned from a roadmap differentiator to a core infrastructure requirement. The evaluation criteria have shifted from “Do you have AI?” to “Is your AI native or integrated?” and “Is it Agentic?”

- Generative AI (GenAI) has become table stakes for summarization and agent assistance.

- Agentic AI represents the new frontier, where autonomous agents handle complex, multi-turn resolutions without human intervention.

- Openness vs. Native Power: Vendors are being rigorously evaluated on the “openness” of their AI architecture. Enterprises are asking whether they can swap out a vendor’s generic Large Language Model (LLM) for a fine-tuned, industry-specific model hosted within their own private cloud.

3. In-Depth Vendor Analysis: The “Big Three” Leaders

3.1 Genesys Cloud CX: The Experience Orchestration Engine

Genesys has successfully executed one of the most complex pivots in the software industry, transforming from a legacy on-premise hardware giant to a cloud-native leader. Its flagship platform, Genesys Cloud CX, is widely regarded in 2026 as the most modern, balanced, and “all-in-one” solution available to the enterprise market.

Architectural Philosophy and Market Position

Genesys Cloud CX distinguishes itself through a “API-first” microservices architecture. Unlike competitors that have grown primarily through the acquisition of disparate codebases—leading to a “Frankenstein” backend where data does not flow seamlessly between modules—Genesys Cloud was built natively to ensure unity. This architectural purity results in a seamless administrator and agent experience where data flows freely between voice, digital, and WEM modules without the need for complex ETL (Extract, Transform, Load) processes. The market has rewarded this coherence; Genesys is the only vendor ranked #1 in three out of five Critical Capabilities use cases by Gartner (High-Volume Customer Call Center, Customer Engagement Center, Global Contact Center).

Core Strengths for the Enterprise

- Experience Orchestration: Genesys excels in “Journey Management.” The platform allows organizations to visualize and influence the customer path across web, mobile, and contact center touchpoints before a voice interaction even begins. This capability, powered by “Predictive Engagement,” allows an enterprise to interject a chat bot or a proactive offer based on real-time website behavior, significantly increasing conversion rates.

- Global Reach and Media Fabric: For multinational corporations, latency is the enemy of voice quality. Genesys utilizes a distributed cloud architecture known as “Global Media Fabric,” which allows voice traffic to stay local (reducing latency and carriage costs) while control signaling is centralized in the customer’s home region. It supports bring-your-own-carrier (BYOC) options and provides native carrier services in approximately 40 countries, with partner coverage extending to nearly every region globally.

- Rapid Innovation Velocity: The platform’s continuous delivery model pushes updates weekly, ensuring that all customers are instantly on the latest version. This contrasts with the upgrade cycles of hosted private cloud solutions.

Enterprise Considerations and Limitations

- Premium Pricing: Genesys is unapologetically priced as a premium solution. While the Total Cost of Ownership (TCO) can be favorable due to vendor consolidation (retiring separate WFM, QM, and Dialer systems), the upfront licensing costs are significant and often higher than mid-market competitors.

- Complexity for Administrators: The sheer depth of features—while a strength—can create a steeper learning curve for system administrators compared to simpler tools like Talkdesk or Dialpad. Configuring complex routing logic and AI flows requires a skilled, often certified, administrator.

3.2 NICE CXone: The Analytics and WEM Powerhouse

NICE CXone (formerly NICE inContact) represents the fusion of a robust cloud routing engine with NICE’s deep heritage in data analytics and workforce optimization. For organizations where the contact center is viewed primarily as a data mine and a labor optimization challenge, NICE remains the gold standard.

Architectural Philosophy and Market Position

NICE’s strategy centers on its “Open Cloud Platform” and the comprehensive nature of its suite. Having acquired inContact, it layered its world-class enterprise WEM and Analytics tools on top of the cloud routing layer. While this initially created some integration friction, recent updates (branded as CXone Mpower) have significantly unified the user interface. NICE consistently scores highest for “Strategy” in Forrester Wave evaluations and is favored by organizations with rigid compliance needs.

Core Strengths for the Enterprise

- Workforce Engagement Management (WEM) Superiority: For global banks, insurers, and telcos where workforce scheduling involves tens of thousands of agents, complex union rules, shift bidding, and intricate labor forecasting, NICE is unrivalled. Their WEM tools are widely considered deeper and more granular than Genesys’s native offerings, often eliminating the need for niche third-party WFM software.

- AI & Analytics (Enlighten): NICE’s “Enlighten AI” is a mature, purpose-built AI engine trained on billions of historical CX interactions. Unlike generic models, Enlighten excels in specialized tasks such as sentiment analysis, compliance monitoring, and objective agent scoring. It can automatically score 100% of calls for quality assurance, a massive leap from the traditional manual sampling of 1-2% of calls.

- Customer Sentiment: NICE was the only vendor designated a “Customers’ Choice” in the 2024 Gartner Peer Insights for the enterprise segment, indicating a high degree of satisfaction among actual users in large-scale deployments.

Enterprise Considerations and Limitations

- UX Consistency: Because portions of the suite were acquired, some legacy users report a disjointed experience when navigating between different modules (e.g., moving from routing to Quality Management), although the new Mpower interface aims to resolve this.

- Implementation Heavy: Due to its complexity and depth, NICE deployments can be resource-intensive and often require significant professional services engagement compared to lighter platforms. It is a “heavy machinery” solution that requires skilled operators.

3.3 Amazon Connect (AWS): The Builder’s Toolkit and Disruptor

Amazon Connect disrupted the market fundamentally by offering a pay-as-you-go, completely cloud-native contact center built on the same infrastructure that powers Amazon’s own massive customer service operations. It appeals to a fundamentally different buyer persona: the CTO or VP of Engineering who values code over configuration.

Architectural Philosophy and Market Position

Amazon Connect is less a “product” in the traditional sense and more a set of highly composable building blocks (services). It adheres to the “Infrastructure as Code” philosophy. This allows for unparalleled flexibility but shifts the burden of assembly to the customer. It is the “Architectural Disruptor” that challenges the very notion of a pre-packaged CCaaS suite.

Core Strengths for the Enterprise

- Infinite Scalability & Reliability: As a Tier-1 AWS service, Connect inherits the massive resilience of the AWS cloud. It can scale from ten agents to ten thousand agents instantly without the need for provisioning or capacity planning. The “Global Resiliency” feature allows for seamless failover of an entire contact center instance to a different AWS region—a capability that is often an expensive add-on or a complex architectural project with other vendors.

- Consumption-Based Cost Model: The pricing model (approx. $0.018 per minute) is highly attractive for businesses with erratic volumes, such as seasonal retailers or disaster relief hotlines. There are no “agent seat” licenses to buy, meaning an enterprise pays zero fixed costs for agents who are not actively handling calls.

- Deep Ecosystem Integration: For organizations already heavily invested in the AWS ecosystem (using Lambda for logic, Lex for bots, DynamoDB for data, S3 for storage), Connect offers unmatched integration flexibility. It acts as a native extension of the enterprise’s existing cloud infrastructure.

Enterprise Considerations and Limitations

- “Assembly Required”: Connect is often described as a box of Lego bricks without the instruction manual. While powerful, it lacks the deep, out-of-the-box user interfaces for agents and supervisors that Genesys and NICE provide. Enterprises often find themselves needing to build a custom agent desktop or purchase a third-party overlay (like Salesforce Service Cloud Voice) to make it usable for frontline staff.

- Feature Gaps in WEM: Native capabilities for workforce management and advanced historical reporting have historically lagged behind the specialist vendors. While AWS is rapidly adding these features, they are often less mature than the multi-decade refinements found in NICE or Genesys.

- Hidden Costs: While the minute rate is low, enterprise-grade support (AWS Enterprise Support) can be expensive (starting at $15k/month or a percentage of spend), and complex configurations can drive up “hidden” costs like custom Lambda invocations, Kinesis data streams, and storage fees.

3.4 The Challengers: Five9, Talkdesk, and Cisco

While the “Big Three” dominate the conversation, other players remain vital for specific scenarios.

- Five9: Often seen as the “Goldilocks” solution—easier to deploy than Genesys/NICE but more feature-complete out of the box than AWS. Five9 excels in the mid-to-large enterprise segment, particularly in North America, and is renowned for its “White Glove” implementation service which often rescues failed deployments from other vendors.

- Cisco (Webex Contact Center): Remains a strong contender for organizations heavily entrenched in the Cisco ecosystem for networking and Unified Communications (UCaaS). However, its cloud transition has been slower, and it often trails in pure innovation velocity compared to the cloud-native leaders.

- Talkdesk: A “Visionary” known for its extremely intuitive user interface and ease of use, making it popular for digital-first companies. However, recent analyst reports have noted some concerns regarding its financial stability and executive turnover relative to the giants.

4. Architectural Deep Dive: Unified vs. Composable

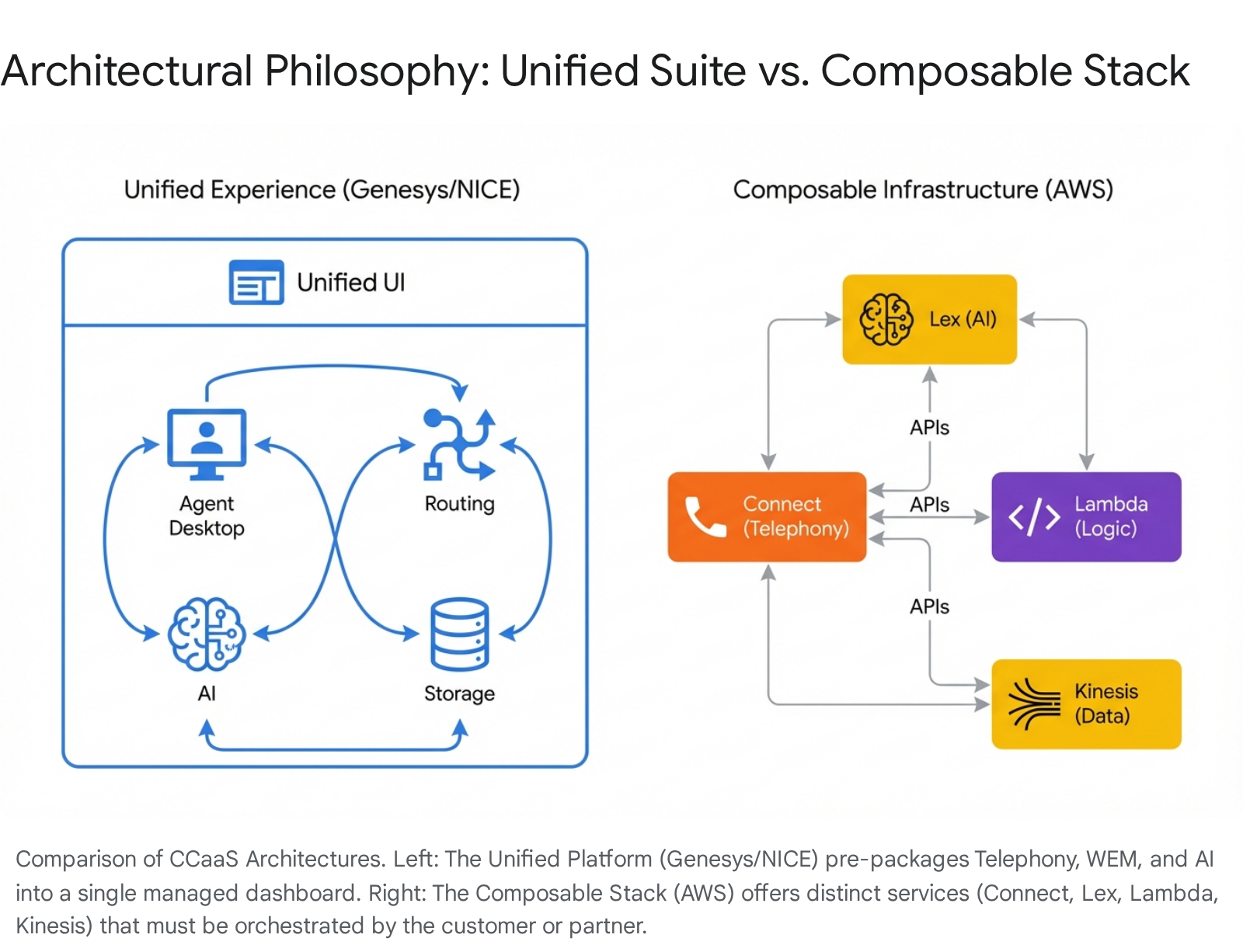

For a global “Big Corp,” the physical location and logical structure of the infrastructure are paramount due to latency sensitivities and data sovereignty (GDPR/local residency) requirements. The industry is currently divided between two architectural philosophies: the Unified Platform and the Composable Stack.

4.1 The Unified Platform (Genesys & NICE)

This approach delivers a pre-packaged, comprehensive suite where telephony, WEM, AI, and digital channels are tightly integrated into a single vendor-managed environment.

- Advantages: Reduced vendor management overhead, consistent UI/UX, unified data model, and single-point-of-contact for support.

- Disadvantages: “Vendor lock-in”—it is difficult to swap out just one component (e.g., the dialer) if it doesn’t meet needs.

- Global Media Fabric: Genesys exemplifies this with its ability to decouple media (voice path) from signaling (logic). A call in Australia stays in Australia, even if the routing logic is processed in a US control plane, ensuring high voice quality.

4.2 The Composable Stack (AWS Connect)

This approach treats the contact center as a set of programmable services that can be orchestrated alongside other enterprise applications.

- Advantages: Ultimate flexibility. An enterprise can use AWS for telephony, Google for AI, and a custom-built React app for the agent interface.

- Disadvantages: High operational complexity. The enterprise effectively becomes a software development shop, responsible for maintaining the “glue” code between services.

- Resiliency: AWS’s “Global Resiliency” is a standout feature, allowing for active-active configurations across regions, a critical requirement for mission-critical banking or emergency service operations.

5. The AI Battleground: Native vs. Integrated

In 2026, AI is evaluated on three distinct layers: Self-Service (Bots), Co-Pilot (Agent Assist), and Analytics (Insights). The debate centers on whether “Native AI” (embedded into the core platform) is superior to “Bolted-on AI” (integrated via third-party partners).

5.1 The Native Advantage

Genesys and NICE have aggressively integrated AI directly into their interaction flows.

- Genesys Predictive Engagement: This tool tracks customer behavior on a website in real-time (e.g., a customer hesitating on a mortgage application page) and uses AI to trigger a proactive intervention, such as a chat offer or a callback. This integration of web behavioral data with contact center routing is a key differentiator.

- NICE Enlighten AI: This is a comprehensive AI suite that provides real-time coaching to agents. For example, it can analyze voice patterns to detect if a customer is becoming frustrated and prompt the agent to “Show more empathy” or “Slow down.” Because it is pre-trained on billions of interactions, it works “out of the box” with less tuning than generic models.

5.2 The Innovation Gap and AWS

AWS offers powerful tools like Amazon Q and Amazon Lex for building conversational AI.

- Flexibility: The advantage of AWS is its pace of innovation. With access to Amazon Bedrock, customers can potentially integrate the absolute latest Large Language Models (LLMs) from Anthropic, AI21, or Cohere faster than a packaged vendor might integrate them.

- Configuration Debt: However, reviews and case studies suggest that configuring these tools to match the nuance of a pre-trained industry model from NICE or Genesys takes significant effort. An enterprise might spend months tuning a Lex bot to achieve the same containment rate that a Genesys “Smart App” delivers in weeks.

- Agent Copilots: Currently, Genesys Agent Copilot and NICE Enlighten Copilot are viewed as superior to Amazon Q in Connect for immediate agent productivity. They offer auto-summarization and knowledge surfacing that is tightly coupled with the agent workspace, whereas AWS often requires more custom configuration to achieve the same seamless workflow.

6. Workforce Engagement Management (WEM): The Operational Core

For many large enterprises, WEM is the single biggest functional differentiator. It dictates how efficiently the labor force—often the largest cost center—is utilized.

6.1 NICE: The Undisputed Leader

NICE remains the benchmark for WEM. Its forecasting algorithms are battle-tested in deployments with over 20,000 agents. For organizations with complex requirements—such as multi-skill blending (agents doing chat and voice simultaneously), intricate union rules regarding breaks and overtime, or shift bidding processes—NICE is the safest choice. Its ability to forecast for digital channels (which have different arrival patterns than voice) is particularly advanced.

6.2 Genesys: Closing the Gap

Genesys has made massive strides with its native WEM. It is now considered sufficient for 90% of enterprises. A key strength of Genesys WEM is the user experience for the agent. It offers a mobile app that allows agents to trade shifts, view schedules, and request time off with a consumer-grade UI. This focus on “Employee Experience” (EX) is critical for retention in a high-turnover industry.

6.3 AWS and Five9: The Partner Dependency

AWS and Five9 have historically lagged in native WEM depth. While AWS has released forecasting and scheduling modules, they are often too basic for complex enterprise needs. Consequently, AWS frequently advises customers to use partners like Calabrio or Verint for WEM. While functional, this re-introduces the complexity of managing two separate vendors and integrations—precisely the friction that the “all-in-one” CCaaS platforms aim to remove.

7. Financial Framework: TCO and Licensing Models

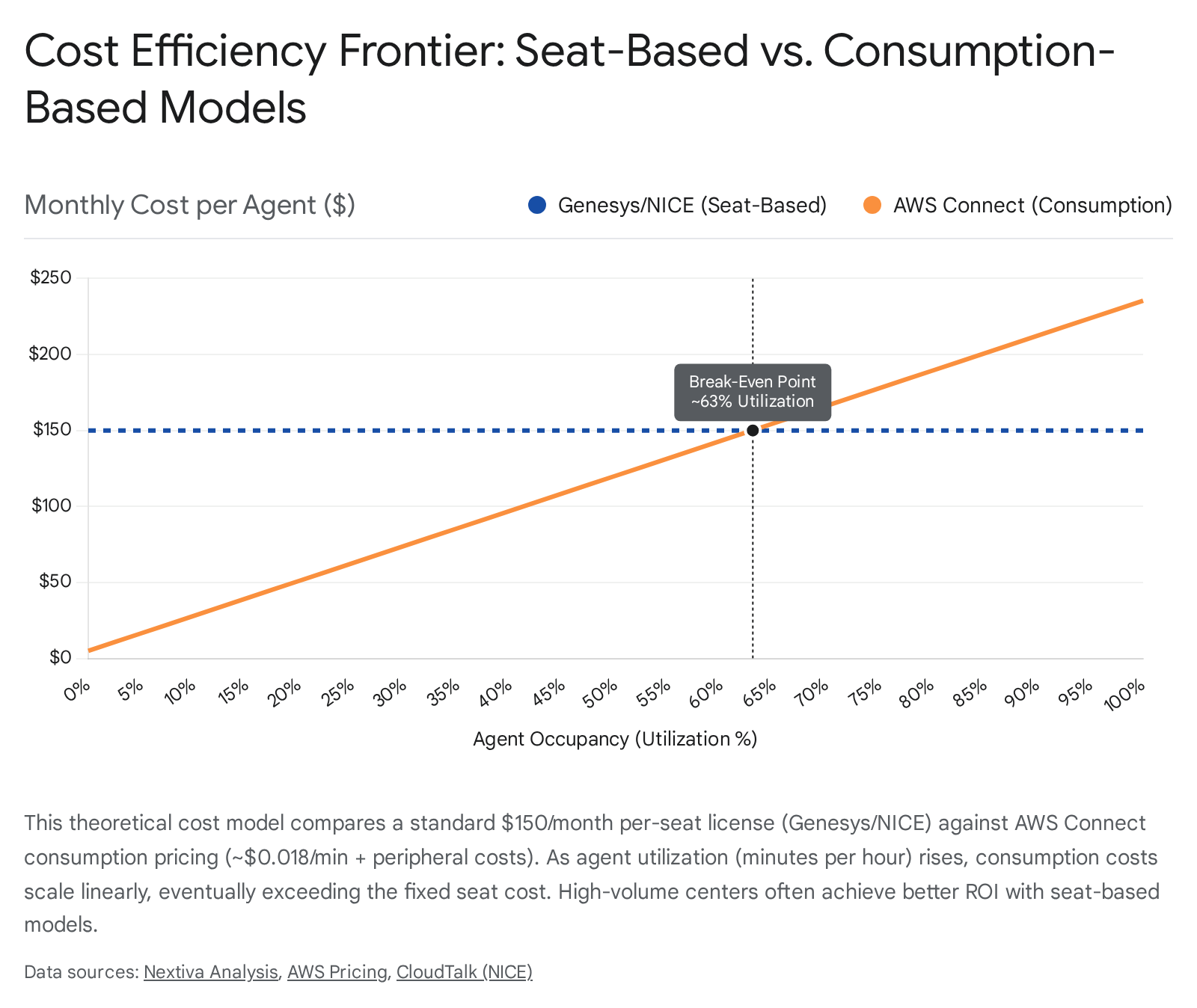

For a “Big Corp,” the cost structure is as important as the feature set. The industry offers two distinct models, and the “cheaper” option depends entirely on usage patterns.

7.1 The Predictable Bundle (Genesys & NICE)

These vendors typically utilize a Named or Concurrent User licensing model.

- Structure: Tiers (e.g., Genesys Cloud CX 1, 2, 3 or NICE Core/Complete Suites) bundling Voice, Digital, and WEM capabilities.

- Pros: Predictability. The budget is fixed regardless of how many minutes an agent talks. It allows for “all-you-can-eat” usage of features within the tier.

- Cons: Shelfware risk. You pay for the seat license even if the agent is sick, on vacation, or idle.

- Cost Estimate: A fully loaded enterprise seat (Omnichannel + WEM + Analytics) typically ranges from $135 to $200+ per user/month.

7.2 The Consumption Model (AWS)

AWS charges based on pure usage (per minute, per message, per API call).

- Structure: Pay only for what you consume. $0.018 per minute for voice, plus charges for data storage, Kinesis streams, etc.

- Pros: Alignment. Costs scale perfectly with business volume. Ultra-low cost for low-traffic periods. No “shelfware.”

- Cons: Volatility. Costs are hard to forecast and can spike during crises (when call volumes explode). Complex “hidden” costs—enterprises must model the cost of CloudWatch logs, S3 storage, and Lambda invocations, which can add 20-30% to the base minute rate.

- The Tipping Point: Analysis suggests that for high-occupancy contact centers (where agents are talking 40-50 minutes per hour), the per-minute model of AWS often becomes more expensive than a flat concurrent license from Genesys or NICE. Conversely, for low-occupancy centers (e.g., internal helpdesks), AWS is significantly cheaper.

8. Risk, Security, and Compliance

For global enterprises, security is non-negotiable. The “Big Three” all maintain a robust posture, but there are nuanced differences in their authorization levels.

8.1 Certifications and Authorization

- Genesys Cloud CX: Maintains a broad compliance portfolio including ISO 27001, 27017, and 27018. Crucially, it is FedRAMP Moderate Authorized and HIPAA compliant. It also holds SOC 2 Type II attestation. This covers the vast majority of commercial and state government requirements.

- NICE CXone: Also FedRAMP Moderate Authorized (with FedRAMP High options available in specific isolated environments). It holds PCI Level 1, HITRUST, and SOC 2 Type II. NICE’s strong footprint in the federal sector drives its high compliance standards.

- AWS Connect: A significant differentiator for US Federal Government or Defense clients is that Amazon Connect has achieved FedRAMP High Authorization. This allows it to handle the most sensitive unclassified government data, a tier above the “Moderate” authorization held by the standard deployments of its competitors.

8.2 Reliability and Outage Management

- AWS: While generally offering stellar reliability, the centralized reliance on the US-EAST-1 region has historically caused high-profile, cascading outages (e.g., October 2025). These events impacted Amazon Connect customers who had not specifically architected for multi-region failover. The “shared responsibility” model means the customer is responsible for designing this redundancy, which is a non-trivial engineering task.

- Genesys/NICE: These vendors offer strong SLAs (typically 99.99%) and, crucially, take full responsibility for the application layer uptime. They operate on active-active architectures where failover is handled by the vendor, not the customer. Their financially backed SLAs are often easier to enforce and claim against than AWS’s infrastructure-level SLAs, which may exclude “customer misconfiguration”.

9. The Verdict: Selecting the “Best” for Your Enterprise

The definition of “best” is situational. Based on the analysis of architecture, AI, financials, and operational depth, the following strategic recommendations apply.

Recommendation A: Choose Genesys Cloud CX If…

- You prioritize Experience Orchestration: You want a single, cohesive platform that unifies digital and voice journeys natively without integration duct tape.

- You value User Experience (UX): You want a modern, intuitive interface for agents and supervisors that requires minimal training and boosts employee retention.

- You are a commercial enterprise: You are in Retail, Finance, or Technology and need rapid innovation velocity to stay competitive.

- Verdict: The Best All-Rounder. Genesys is currently the market leader for a reason; it balances power with usability better than any other platform in 2026.

Recommendation B: Choose NICE CXone If…

- WFM is King: Your operations are massive and complex, with thousands of agents, intricate union rules, and deep scheduling needs that generic tools cannot handle.

- Analytics are Critical: You need the deepest possible historical reporting and AI-driven quality management to ensure compliance in a strictly regulated environment.

- You are in a Regulated Industry: You are in Healthcare or Government and value the comfort of a vendor with a massive compliance footprint and specialized deep-dive analytics.

- Verdict: The Safe Bet for Complexity. It is the powerhouse for the analytics-driven, large-scale operation that cannot afford to compromise on detail.

Recommendation C: Choose Amazon Connect If…

- You are an Engineering-First Shop: You have a large team of developers who want to build custom experiences using Lambda and APIs rather than configuring a packaged tool.

- Volume is Highly Variable: Your call volume spikes 10x during holidays and drops to zero otherwise (e.g., a tax service or disaster relief hotline), making seat-based licensing wasteful.

- You are already “All-In” on AWS: You want to keep all data and infrastructure within your existing AWS VPCs and commit to spend agreements.

- Verdict: The Ultimate Scaler. Best for builders who want to pay for usage, not software, and require maximum architectural flexibility.

Recommendation D: Consider Five9 If…

- You are a Mid-to-Large Enterprise: You want a “White Glove” service experience. Five9 is renowned for its implementation support and partnership approach, often outperforming the larger giants in customer care and ease of deployment.

- You are focused on AI Pragmatism: You want practical AI tools (Agent Assist) that work out of the box without over-engineering or requiring a data science team.

Conclusion

In the spectrum of CCaaS solutions globally, Genesys Cloud CX currently holds the title of the “best” all-around solution for the typical Global 2000 enterprise that values a balance of innovation, usability, and unified architecture. However, NICE CXone remains the superior choice for organizations where workforce optimization is the primary operational constraint, and Amazon Connect is the unrivaled choice for organizations that view the contact center as a software engineering challenge rather than a packaged application purchase. Decision-makers should move beyond simple feature checklists and evaluate vendors on their architectural philosophy (Unified vs. Composable) and pricing alignment (Seat vs. Usage) to ensure the chosen platform supports their long-term customer experience strategy. The “best” solution is the one that aligns most frictionlessly with the enterprise’s own operational culture and future aspirations.

Works cited

- AWS recognized as a Leader in 2024 Gartner Magic Quadrant for …, https://aws.amazon.com/blogs/contact-center/aws-recognized-as-a-leader-in-2024-gartner-magic-quadrant-for-contact-center-as-a-service-with-amazon-connect/

- Gartner Magic Quadrant for Contact Center as a Service (CCaaS …, https://www.cxtoday.com/contact-center/gartner-magic-quadrant-for-contact-center-as-a-service-ccaas-2024-the-rundown/

- The Forrester Wave for CCaaS Platforms 2025: Top Takeaways, https://www.cxtoday.com/contact-center/the-forrester-wave-for-ccaas-platforms-2025-top-takeaways/

- Critical Capabilities for Contact Centre as a Service - Genesys, https://www.genesys.com/en-sg/resources/critical-capabilities-for-contact-center-as-a-service

- Genesys vs. Amazon Connect - Choose the best for your business, https://www.genesys.com/advantages/genesys-vs-amazon-connect

- Gartner Peer Insights “Voice of the Customer” for CCaaS 2024, https://www.cxtoday.com/contact-center/gartner-peer-insights-voice-of-the-customer-for-ccaas-2024/

- Amazon Connect vs Twilio Flex vs Genesys Cloud CX - Medium, https://medium.com/@persisduaik/the-contact-centre-dilemma-amazon-connect-vs-twilio-flex-vs-genesys-cloud-cx-dfe528bd4667

- Aegis CX vs. Genesys, NICE, & Five9: 2025 CCaaS Platform …, https://intelligentvisibility.com/aegis-cx-vs-ccaas-market-comparison

- Genesys Reaches $1.8BN in Annual Recurring CCaaS Revenues, https://www.cxtoday.com/contact-center/genesys-reaches-1-8bn-in-annual-recurring-ccaas-revenues/

- Five9 Surpasses $1 Billion in Annual Revenue Run Rate, https://investors.five9.com/news-releases/news-release-details/five9-surpasses-1-billion-annual-revenue-run-rate/

- NiCE named a CCaaS Leader in The Forrester Wave™ 2025, https://www.nice.com/lps/forrester-wave-ccaas-2025

- NiCE vs Genesys Cloud CX, https://www.nice.com/info/nice-cxone-vs-genesys-cloud

- Compare Connect vs. Genesys Cloud CX | G2, https://www.g2.com/compare/amazon-connect-vs-genesys-cloud-cx

- Genesys Cloud CX Pricing, https://www.genesys.com/pricing

- NICE CXone vs. Genesys Cloud: The Ultimate CCaaS Battle, https://www.cxtoday.com/contact-center/nice-cxone-vs-genesys-cloud-the-ultimate-ccaas-battle/

- AWS regions for Genesys Cloud Voice, https://help.mypurecloud.com/articles/aws-regions-genesys-cloud-voice/

- Global Voice for Genesys: Everything You Need To Know - AVOXI, https://www.avoxi.com/blog/global-voice-for-genesys/

- Genesys Cloud CX: Pros, Cons, and Competitors - Macronet Services, https://macronetservices.com/genesys-cloud-cx-pros-cons-and-competitors/

- NiCE Is A 2024 Gartner® Peer Insights™ CCaaS Customers’ Choice, https://www.nice.com/press-releases/nice-is-a-2024-gartner-peer-insights-ccaas-customers-choice

- Genesys vs NICE: In-Depth Comparison of Features, Pricing, and …, https://www.ringover.co.uk/blog/genesys-vs-nice

- Nice CXONE vs Genesys Cloud CX vs Nextiva. Are these any good …, https://www.reddit.com/r/ITManagers/comments/1bvbhjz/nice_cxone_vs_genesys_cloud_cx_vs_nextiva_are/

- Revealing the Cascading Impacts of the AWS Outage | Ookla®, https://www.ookla.com/articles/aws-outage-q4-2025

- Amazon Connect vs. Genesys: Which CCaaS Platform Is Better?, https://www.nextiva.com/blog/genesys-vs-amazon-connect.html

- Amazon Connect Pricing - AWS, https://aws.amazon.com/connect/pricing/

- AWS Support Plan Pricing, https://aws.amazon.com/premiumsupport/pricing/

- NICE CXone Pricing: Paying More for Just Basics? - JustCall, https://justcall.io/hub/cost/nice-cx-one-pricing/

- Five9 Named a Leader in IDC MarketScape for European CCaaS, https://www.five9.com/blog/five9-named-leader-idc-marketscape-european-ccaas

- What is Competitive Landscape of Five9 Company? - Matrix BCG, https://matrixbcg.com/blogs/competitors/five9

- Genesys vs. Amazon Connect vs. MaxContact: Which CCaaS Option …, https://www.cxtoday.com/contact-center/genesys-vs-amazon-connect-vs-maxcontact-which-ccaas-option-is-best-for-you/

- 2024 Gartner Magic Quadrant for CCaaS: Why Smarter WEM Matters, https://www.calabrio.com/wfo/contact-center-reporting/why-smarter-wem-solutions-matter-calabrios-view-on-the-2024-gartner-magic-quadrant-for-ccaas/

- NICE CXone Pricing & Plans: Full Guide 2026 - CloudTalk, https://www.cloudtalk.io/blog/nice-cxone-pricing/

- Calculating the Total Cost of Ownership for Amazon Connect - USAN, https://usan.com/blog/calculating-the-total-cost-of-ownership-for-amazon-connect

- FedRAMP compliance - Genesys Cloud Resource Center, https://help.mypurecloud.com/articles/fedramp-compliance/

- Supported security, privacy, and AI standards, https://help.mypurecloud.com/articles/supported-security-standards/

- Audits and Certifications - NiCE, https://www.nice.com/company/trust-center/audits-and-certifications

- Amazon Connect achieves FedRAMP High authorization, https://aws.amazon.com/blogs/publicsector/amazon-connect-achieves-fedramp-high-authorization/

- Amazon Connect Secures FedRAMP Authorized Status At High …, https://www.potomacofficersclub.com/news/amazon-connect-secures-fedramp-authorized-status-at-high-impact-level/

- How AWS Complies with FedRAMP for U.S. Agencies - Aquasec, https://www.aquasec.com/cloud-native-academy/cloud-compliance/aws-fedramp/

- AWS Outage Analysis: October 20, 2025 - ThousandEyes, https://www.thousandeyes.com/blog/aws-outage-analysis-october-20-2025

- AWS’ 15-Hour Outage: 5 Big AI, DNS, EC2 And Data Center Keys To …, https://www.crn.com/news/cloud/2025/aws-15-hour-outage-5-big-ai-dns-ec2-and-data-center-keys-to-know

- Genesys Cloud Service Level Agreement View summary, https://help.mypurecloud.com/articles/service-level-agreements/

- SLA Guarantee - NiCE, https://www.nice.com/company/sla-guarantee